Returns from Lysa Global Equity Broad will now be taxed as Aktieindkomst

2024-12-17

Historical returns are no guarantee of future returns. An investment can both increase and decrease in value, and it is not certain that you will get back the invested capital.

At Lysa, we continuously work to improve our customers’ savings. Earlier this autumn, our global equity fund, Lysa Global Equity Broad, became a directly-investing index fund. This change has enabled further improvements, this time related to the taxation of your holdings as a Danish Lysa customer. Starting January 1, 2025, returns from your holdings in Lysa Global Equity Broad will be taxed as Aktieindkomst (share income) instead of Kapitalindkomst (capital income). This means lower taxes on returns for many of our Danish customers.

Please note that this change only affects Danish Lysa customers and applies exclusively to Lysa Global Equity Broad. Lysa’s other funds will continue to be taxed as Kapitalindkomst.

Taxation as Aktieindkomst - the most common feedback

We launched our service in Denmark in 2021. Since then, the most requested feedback from our customers has been to have our equity funds taxed as Aktieindkomst instead of Kapitalindkomst. This feedback was further emphasized this fall, when we conducted a customer survey among our Danish customers to explore how we can improve our services.

We have listened to your feedback and during the past months made this our primary focus for product development in Denmark. Therefore, we are excited to announce this change already from January 1, 2025.

Lower taxes for many, the change happens automatically

The equity portion of Lysa’s portfolio in Denmark consists of three funds:

- Lysa Global Equity Broad (global equity fund)

- Lysa Emerging Markets Equity Broad (emerging markets fund)

- Lysa Global Small Cap Equity Broad (global small-cap fund)

Returns from Lysa Global Equity Broad, which currently makes up about 80% of the equity portion (1), will be taxed as Aktieindkomst instead of Kapitalindkomst. Returns from the other two equity funds (as well as the fixed-income portion) will continue to be taxed as Kapitalindkomst. Which portion of your portfolio that is to be taxed as Aktieindkomst versus Kapitalindkomst depends on your target allocation between shares and fixed-income on your Lysa-account.

Lower taxes (for many)

Whether taxation as Aktieindkomst or Kapitalindkomst is more favorable depends on individual circumstances. However, taxation as Aktieindkomst often results in lower taxes (up to a yearly threshold) than Kapitalindkomst.

In 2025, taxation as Aktieindkomst means returns on securities up to DKK 63,300 is taxed at 27%, and returns exceeding this amount is taxed at 42%. (2)

The change happens automatically

You do not need to do anything; we will implement the change automatically for all our customers. We will also continue to automatically report to SKAT so that the tax information is pre-filled in your tax return. (3)

Please note that this applies from 2025. Returns from Lysa Global Equity Broad from 2024 will still be taxed as Kapitalindkomst in the tax return filed in 2025.

Questions? Feel free to contact us!

If you have any questions, please don’t hesitate to contact our customer support via the message function on your Lysa-account. You can also reach us by phone at +4592455740, or via email at [email protected].

Footnotes

(1) The allocation may change over time depending on how global markets develop. The goal is for the distribution between Lysa’s equity funds to reflect their respective weights in the market.

(2) Tax rates link.

(3) However, always remember that it is your responsibility to ensure that your tax return is accurate and complete, and that you are obliged to correct any inaccuracies (including inaccuracies in the information reported by Lysa).

FAQ

How much of my holdings will be taxed as Aktieindkomst versus Kapitalindkomst?

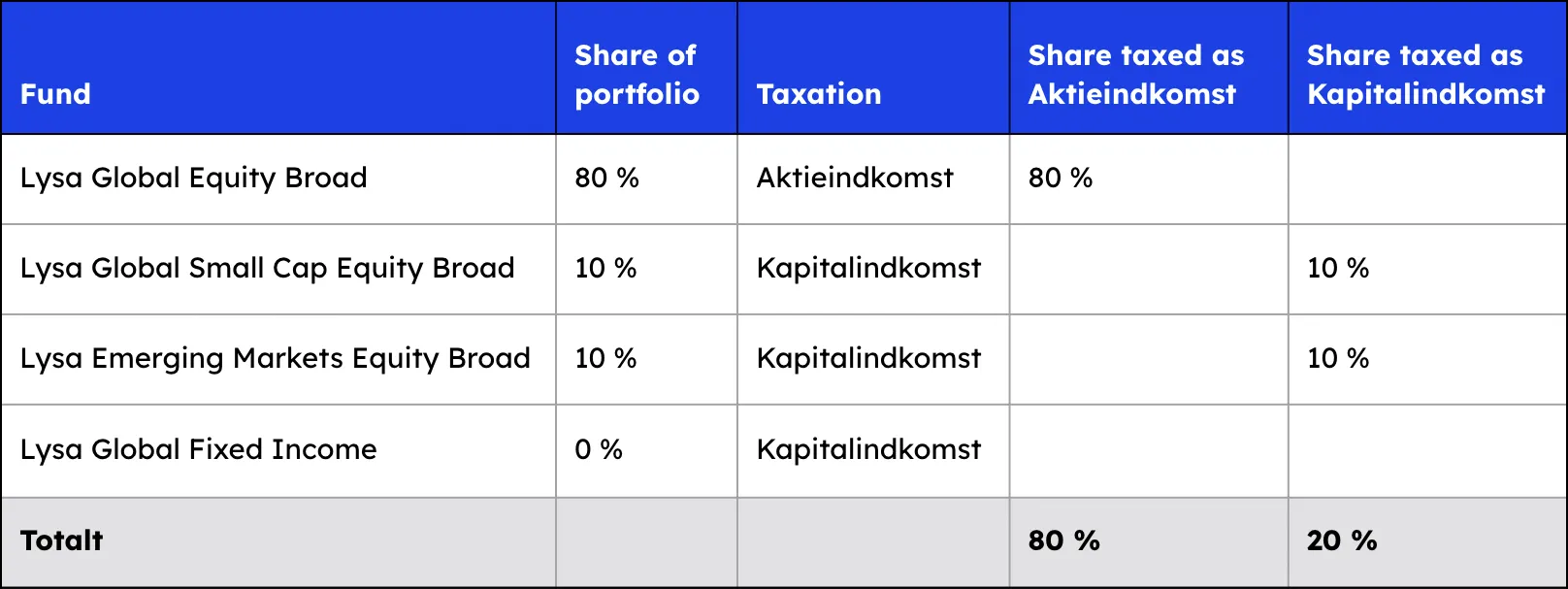

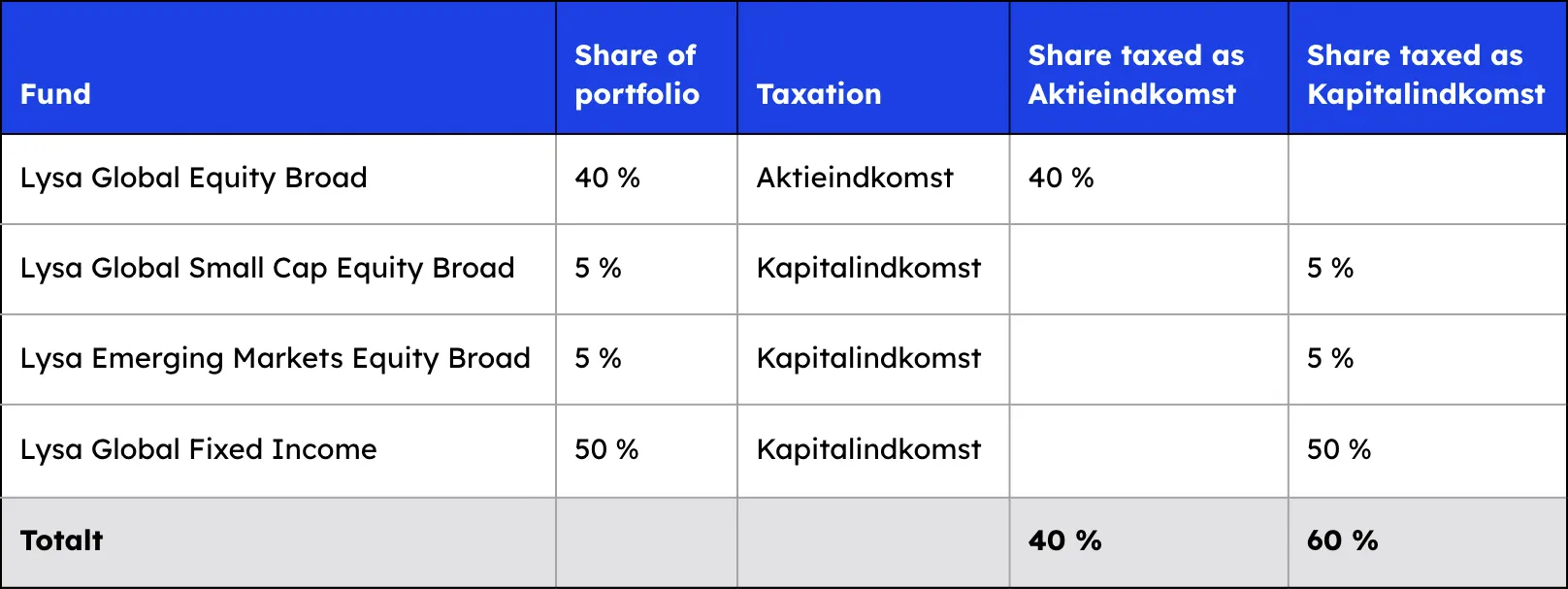

This depends on the target allocation between shares and fixed income on your Lysa account. Lysa Global Equity Broad, which will be taxed as Aktieindkomst, currently accounts for approximately 80% of the equity portion, while the remaining two funds make up around 10% each. See below for two illustrative examples:

Example 1: Target allocation 100 % share

Return from 80 % of the portfolio is taxed as Aktieindkomst, 20 % as Kapitalindkomst.

Example 2: Target allocation 50 % shares, 50 % fixed-income

Returns from 40 % of the portfolio is taxed as Aktieindkomst, 60 % as Kapitalindkomst.

Note: These examples are based on the current allocation of funds in your portfolio. The allocation may change over time depending on how global markets evolve. The goal is for the distribution between equity funds to reflect their respective weights in the market.

Why hasn’t Lysa made this change earlier?

For a fund to be taxed as Aktieindkomst, it must meet certain requirements and be registered on the so-called Positivlisten (ABIS-list). When Lysa Global Equity Broad transitioned from being a fund-of-funds to a directly-investing index fund, Lysa gained the ability to ensure it met all criteria for registration. Following this change, Lysa decided to register the fund on the list.

Why is only one fund affected by the tax change?

Lysa’s two other equity funds, Lysa Emerging Markets Equity Broad and Lysa Global Small Cap Equity Broad, are feeder funds, meaning they invest in other funds. This type of fund is subject to different requirements than funds that invest directly in equities. Lysa cannot, as of now, ensure that these two funds meet the criteria required for registration on Positivlisten.

Fixed income funds, such as Lysa Global Fixed Income, cannot be taxed as Aktieindkomst and are always taxed as Kapitalindkomst.

Can I choose how my funds are taxed?

No, a fund is taxed either as Aktieindkomst or Kapitalindkomst. However, as a customer, you can decide whether or not to invest in a specific fund.

What if I don’t want to participate in this change?

If you prefer not to have any returns taxed as Aktieindkomst, you can choose to withdraw your money from Lysa to your NEM account. From there, you can decide where to transfer them. By withdrawing your money before January 1, 2025, you will not be affected by the change. Keep in mind that withdrawals usually take between 1–3 business days.

Which is better for me: Kapitalindkomst or Aktieindkomst?

The best form of taxation depends entirely on each individual’s circumstances. Since Lysa doesn’t offer tax advice, we recommend reaching out to a tax advisor or the Danish tax authority for guidance in regards to your situation.

Will this change how Lysa handles tax reporting?

No, everything will continue to be reported automatically to SKAT and will appear in your pre-filled tax return. Prior to this, Lysa will provide a tax statement so that you can review the information we have sent to SKAT.